Table Of Content

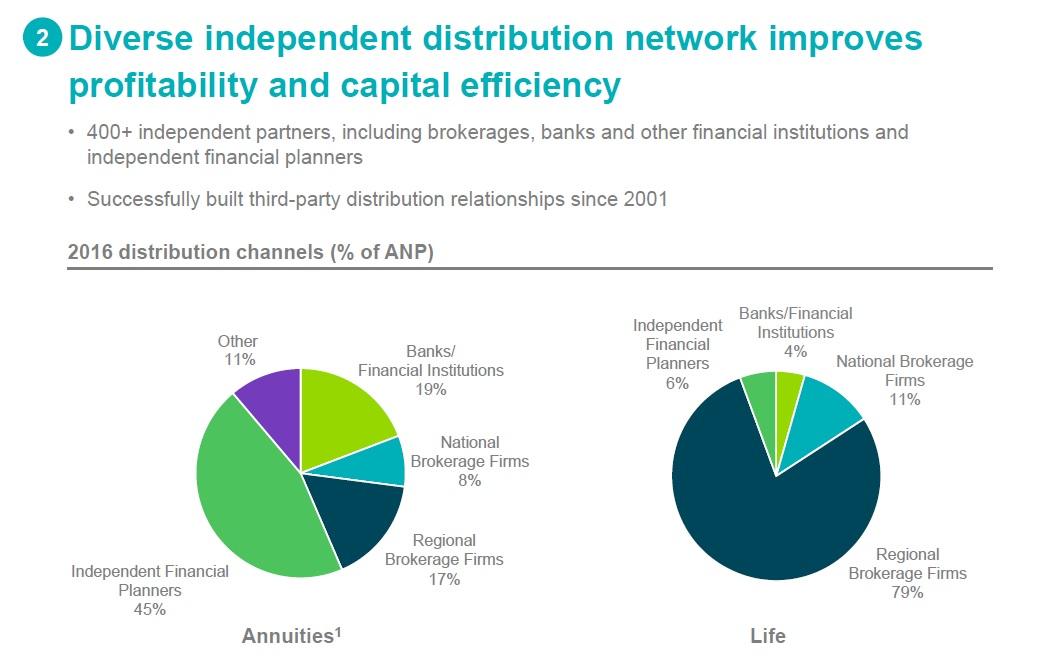

As one of the largest providers of annuities and life insurance in the U.S.,1 we specialize in products that help protect a portion of your portfolio. Buying an annuity to fund a qualified retirement plan or IRA should be done for the annuity’s features and benefits other than tax deferral. Tax deferral is generally a feature of a qualified retirement plan or IRA, so an annuity would not provide an additional tax deferral benefit. References throughout this material to tax advantages, such as tax deferral and tax-free transfers, are subject to this consideration. The product described in this material is not made available to employer-sponsored qualified retirement plans.

Working With a Financial Professional

All guarantees, including any optional benefits, are subject to the claims-paying ability and financial strength of the issuing insurance company. Each issuing insurance company is solely responsible for its own financial condition and contractual obligations. Brighthouse SmartCare has exclusions, limitations, reduction of benefits, and terms under which the policy may be continued in force or discontinued. For costs and complete details of the coverage, please consult your financial professional.

Talking to a Financial Professional About the Benefits of RILAs

Choose 3, 5, or 7 Years of Guaranteed GrowthYou choose how long you want your money to grow (3, 5, or 7 years). Once your initial guarantee period ends, your contract will automatically renew into a subsequent guarantee period of one year, free of a withdrawal charge. Choose your term and other options to fit your specific needs. With so much change in how you plan, save, and invest for the future, delivering products for people like you has never been more necessary. Enter your email address below to receive the latest news and analysts' ratings for Brighthouse Financial and its competitors with MarketBeat's FREE daily newsletter. Ever since its initial public offering (IPO) in August 2017, Brighthouse Financial has been an independent, publicly traded company owned by shareholders and governed by a board of directors.

Brighthouse Financial, Inc. Financial Summary

You may be looking for a guaranteed rate of return, no matter how the economy or markets perform. 2 Growth of LTC benefits relies on the index crediting rate being sufficient to cover annual charges. 1 At the end of the initial guarantee period, the contract will automatically renew into a subsequent guarantee period of one year at the then-current renewal interest rate and will no longer be subject to a withdrawal charge. For each subsequent guarantee period, a new renewal interest rate will be declared.

A message to our customers and financial professionals:

Withdrawals of taxable amounts are subject to ordinary income tax. Withdrawals made before age 59½ may also be subject to a 10% federal income tax penalty. Annuities, stocks, and bonds offer a variety of features and benefits that help diversify a portfolio.

New benefits Amazon is offering employees - About Amazon

New benefits Amazon is offering employees.

Posted: Thu, 20 Jul 2023 07:00:00 GMT [source]

3 AM Best’s Financial Strength Rating is an independent opinion of an insurer’s financial strength and ability to meet its ongoing insurance policy and contract obligations. Any discussion of taxes is for general informational purposes only, does not purport to be complete or cover every situation, and should not be construed as legal, tax, or accounting advice. Clients should confer with their qualified legal, tax, and accounting professionals as appropriate. AM Best’s Financial Strength Rating is an independent opinion of an insurer’s financial strength and ability to meet its ongoing insurance policy and contract obligations. 4 Fitch’s Insurer Financial Strength Rating provides an assessment of the financial strength of an insurance organization. The Insurer Financial Strength Rating is assigned to the insurance company’s policyholder obligations, including assumed reinsurance obligations and contract holder obligations, such as guaranteed investment contracts.

Chris Winfrey: President and CEO Charter - Charter Communications

Chris Winfrey: President and CEO Charter.

Posted: Tue, 26 Oct 2021 15:10:24 GMT [source]

Since the industry average is 1.00, this means Brighthouse Financial receives 60% fewer complaints than the average life insurance company — a great sign that you can expect stellar customer service. Learning about the similarities and differences between different types of investments can be an important first step in understanding whether an annuity may be an option to help meet your long-term retirement goals. Speak with a financial professional about the features you’re seeking and to find out if a RILA may be a possible fit for a portion of your portfolio. 3 Guarantees assume premiums have been paid to keep the policy in force. Benefits paid from the Long-Term Care Acceleration of Death Benefit Rider will reduce the death benefit dollar for dollar and all other values reduce proportionately.

Annuities

It provides your loved ones a death benefit and offers you long-term care (LTC) coverage if you need it. 5 Moody’s Insurance Financial Strength Rating is an opinion of the ability of an insurance company to pay punctually senior policyholder claims and obligations and also reflect the expected financial loss suffered in the event of default. Specific obligations are considered unrated unless they are individually rated because the standing of a particular insurance obligation would depend on an assessment of its relative standing under those laws governing both the obligation and the insurance company. Moody’s Insurance Financial Strength Rating is an opinion of the ability of an insurance company to pay punctually senior policyholder claims and obligations and also reflect the expected financial loss suffered in the event of default.

Fixed Rate Annuities

Use this product brochure to help prepare for the conversation with your financial professional. Talk to your financial professional about whether a Brighthouse Fixed Rate Annuity is right for you and how to purchase this product. The company has a market cap of $3.04 billion, a P/E ratio of -2.63 and a beta of 1.16. Brighthouse Financial has a 1-year low of $39.24 and a 1-year high of $56.24. The company has a debt-to-equity ratio of 0.63, a current ratio of 0.80 and a quick ratio of 0.80.

If you’re looking for whole life insurance, Brighthouse Financial only offers it as a conversion option for their term life policies. And if you need more than $3 million in coverage, see our picks for the best life insurance companies for high-net-worth individuals. If you need immediate access to cash, consider investments that you can sell more easily and with less potential penalty. Annuities provide varying access to your money, but annuity gains that are withdrawn may be subject to taxes.

Our life insurance and annuity products can only be purchased through a financial professional. Life insurance is a product that guarantees a death benefit – a payment to your beneficiaries in the event of your death – which provides valuable insurance protection that can help offset economic loss in the event of your death. Additionally, some life insurance products can grow cash value on a tax-deferred basis, resulting in funds that can be used during your lifetime.